The term ‘mineral owner’ refers to the sub-surface ownership of an individual. Most mineral owners also own surface rights. Surface rights can be severed from mineral rights, meaning you do not have to live on top of the minerals you own. If you are lucky enough to own the minerals under your property or the surface rights in an area with alternative energy activity, you may profit. Alternative energy compared to conventional energy is based on the surface of the earth. Historically the value of surface rights has varied based on location. One sees this in housing all the time—property near a lake has a higher value. Move that same house into the desert and its value declines. The same goes for owning property near potential locations for solar or wind farms. In West Texas, owners of surface rights have seen their values increase substantially with the boom of alternative energy and conventional energy activity, such as pipelines, water disposal, impoundment, etc. Historically, surface owners had little incentive in the exploration of oil & gas, but with the need for water impoundment for activity, pipeline expansion, equipment storage, etc., the value can exceed that of the mineral estate in some areas.

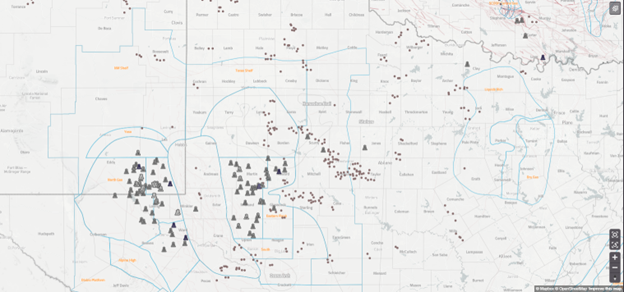

Figure 1: Wind turbine locations across Texas vs. rig locations

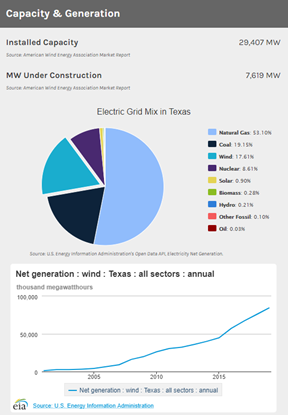

Figure 2: Texas energy sources

Alternative energy is produced from non-carbon-based sources. The components that make up an alternative energy’s power is carbon-based, but that is rarely discussed. Wind turbines are built using plastic or refined alloys/metals, conduit that transfers the power to the grid is made of similar material, many need natural gas generators to start moving, components of electric panels are mined much like coal, etc. Alternative energy is also very visible. Even the largest pad in the U.S. only takes up a few football fields of surface ownership and is not very tall. Many oil & gas wells are hidden behind beautification so that you do not see the pump jacks. Once the well has met the end of its life cycle, it is plugged and the land reclaimed. Alternative energy takes up space both vertically and horizontally and rarely goes away. If you have driven in West Texas or California, you have seen large wind or solar farms in the distant. There is a trade off to the growth of alternative energy and that is the sheer sight and size of it. Alternative energy is an important part of the energy supply chain and will continue to grow as we try and find cheaper methods of energy production. The question many mineral owners will have is, at what cost?

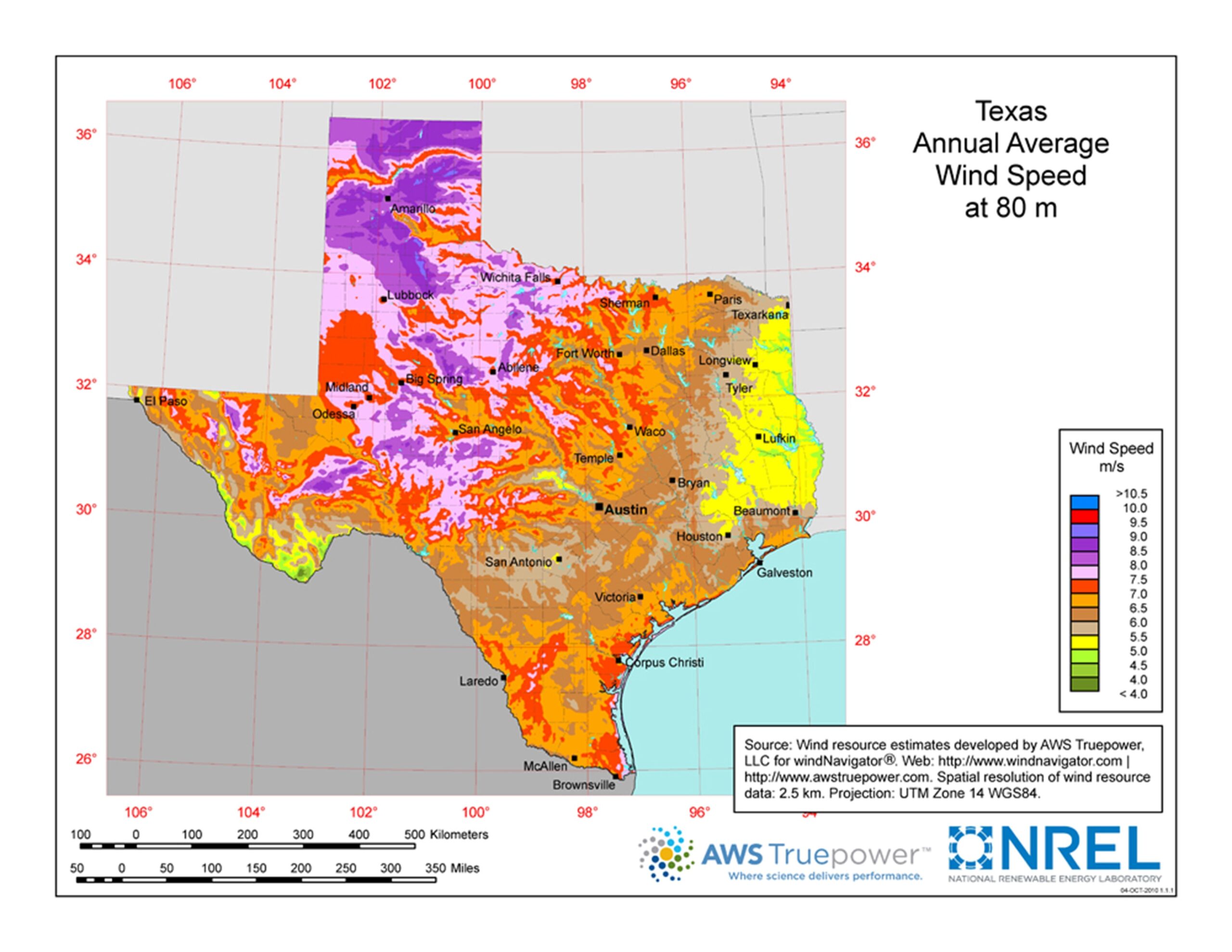

For those that live in Texas, maps are made public to give owners an idea on whether their surface acreage might be within a wind corridor (Figure 3). While you may not have a wind or solar project in your area today, owning acreage in an area that has potential does increase your valuation. Solar and wind leases pay less than an oil & gas lease but are for much longer terms. Many alternative energy leases are 20-30 years long. So, while you may not get a large check in the mail, you can get consistent, long term payments. For many families, it can be better to have a constant stream of money than a few years of large checks. Those that are in an area with both oil & gas and alternative will benefit from the expansion of both energy sources. Energy is not a one size fits all solution and all sources will be explored in powering the U.S. and world over the next few decades.

Figure 3: Potential locations of wind energy based on annual average wind speed