Death and taxes, the only certain things in life. No truer phrase exists. As an owner of non-operated interest in oil and gas there are a lot of complexities that exist in filing taxes. For some, it’s cost depletion vs. standard depletion. For others, it’s protesting ad-valorem taxes. Whether you just hand off your taxes to a CPA or work through them yourself, checking your 1099 is a crucial first step in ensuring your tax filings are correct.

Ensure Accurate Reporting for Your Mineral 1099s

Unlike the neat and tidy tax documents provided to W-2 employees, as a non-operated interest owner, you’re more akin to a contractor, receiving 1099s from various sources. And let’s face it, trusting these forms blindly isn’t in our nature. There is usually less faith in the correctness of the information as part of human nature. Mistakes happen, checks can be cancelled, re-issued or never received. Double checking your 1099’s compared to your actual income for a given year is imperative to ensure you are only paying taxes on what you were paid.

How MIQ+ Can Help You File Your Mineral Rights 1099s

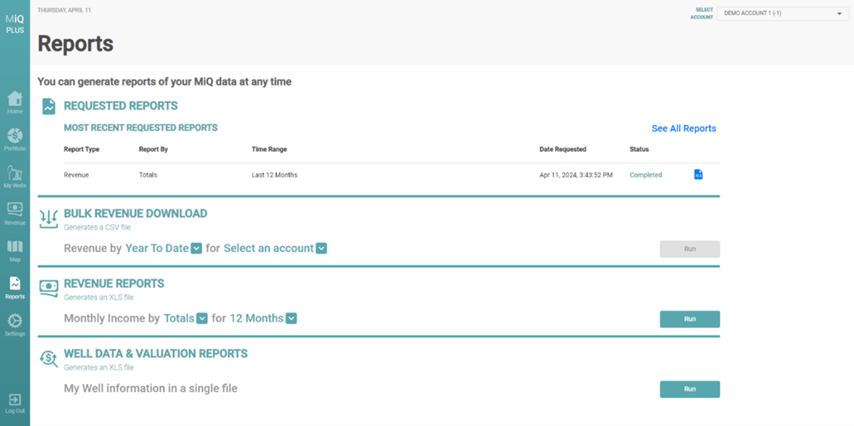

Historically, if you have more than a couple of payors this can be quite cumbersome as you must write down each check, sum them up, then see if they match the 1099. Maybe you lost a check, maybe the numbers don’t match, but you are unsure where the missing information is from. This was one of the reasons we created the Bulk Data Download within MiQ+. Instead of clicking to download each statement, combining them into a single file, then trying to manipulate it into the format you want, we created a single click download of all prior year revenue statements in a single file.

By having all your statement detail in this single file, you can easily create views of income by payor by payment month. If you receive checks under multiple owner numbers with the same payor, see the break down the payments by those unique owner numbers. If you notice your 1099 doesn’t match what you received, it gives you a great starting point to talk with the operator to find the month and check number with the discrepancy. An informed mineral and royalty owner is an empowered owner.

Support and Resources for Mineral Owners

When preparing taxes for mineral and royalty income, accuracy and timeliness are key. As an owner, you may receive 1099s containing essential information about your earnings. Decoding these forms can be complex, but with the right resources, you can optimize your returns and comply with tax regulations.

Avoid common pitfalls like overlooking or misinterpreting 1099s information. These forms contain details about your income, deductions and expenses, which are essential for accurate tax reporting. Carefully review and understand these forms to avoid errors that could trigger an audit or lead to penalties.

Utilize resources and experts in the field to navigate tax preparation complexities.

Stop sifting through PDFs and paper checks, or blindly putting in the information provided on your statements or 1099s. Take control of your tax filings and ensure that what the operator and the government track as your income aligns with what you’ve actually received. Knowledge is power, and being informed empowers you as a mineral and royalty owner. So, say goodbye to the PDF shuffle and embrace a new era of tax clarity. Get all the support and resources you need to manage your mineral assets. With MiQ+, mineral owners gain control, optimize revenue and ensure accurate royalty payments with proper auditing.