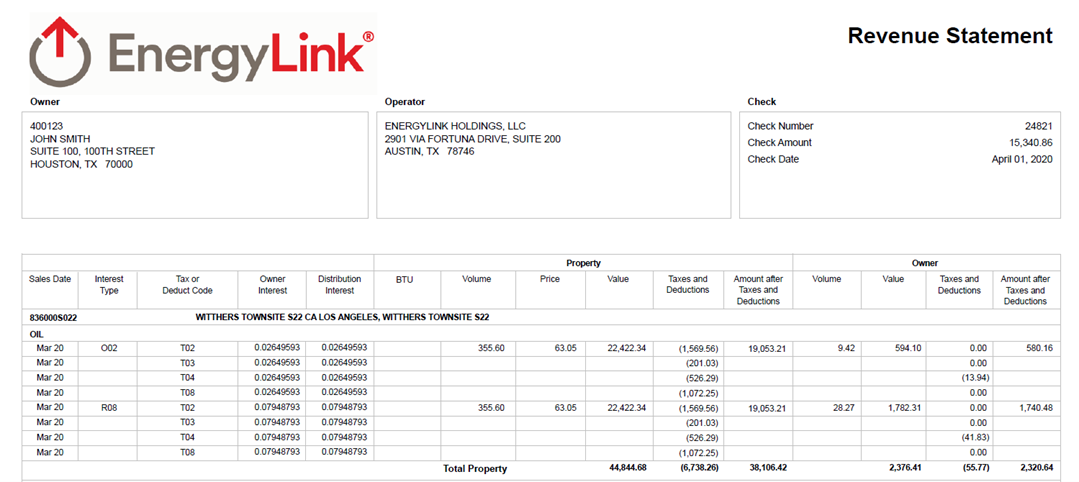

As an individual mineral owner, you receive check stubs from oil & gas companies. Below are definitions of commonly used check stub terms so you can easily navigate the complex business of getting paid on your minerals.

PROPERTY INFORMATION:

- (A) Products: Often indicated with a code, the “products” reported on your statement are the commodities and refined products sold by the operator and include crude oil, natural gas, gas condensate, and natural gas liquids (NGL). Can also include sulfur and CO2.

- (B) API / Well Number: This is a unique code assigned to a well.

- (C) Volume: The amount of product sold for a property and group of interest owners. The measurement type varies with oil and condensate measured in barrels, natural gas in thousands of cubic feet (Mcf), and refined products in gallons.

- (D) Value: The total value of the products sold during the payment period before taxes, adjustments, and deductions for all owners.

- (E) BTU: Measures the quality of natural gas produced and used to calculate property revenue for natural gas volumes.

- (F) Amount After Taxes and Deductions: The total value of products sold minus any taxes, adjustments, or deductions for all owners.

OWNER INFORMATION:

- (G) Interest Type: You may have one or multiple types of interest in a property, including Royalty Interest, Nonparticipating Royalty Interest, and Overriding Royalty Interest. These are often listed as codes with a table provided for reference.

- (H) Owner Number: A unique code assigned to you by an operator. This number is handy if you ever need to contact an operator with a question about your payments or to provide a change of address.

- (I) Owner Interest: Your royalty interest percentage, often the same as Distribution Interest.

- (J) Volume: The amount of product sold for your portion of the overall property.

- (K) Value: Your portion of the property value before taxes, adjustments, and deductions.

- (L) Taxes and Deductions: Post-production expenses such as natural gas dehydration, compression, and processing.

- (M) Amount After Taxes and Deductions: This is your share of the property product sales for the payment period after any taxes, adjustments, and deductions.