Every year, like clockwork, tax season kicks off with a mad rush to find all your check stubs, deductions and receipts. For many, filing taxes is clear cut, but for those with royalties, it is anything but! 1099s provide us with our income information, but there are still real property taxes and deductions, each with its own litany of complications. Let’s take a quick look at how Enverus can assist during tax season through EnergyLink & MineraliQ.

1099s

The basis for our income filing is understanding how much we made. Some owners don’t know this, but 1099s for many in-network operators can be found within EnergyLink. Why wait to receive them in the mail when you can download them online?

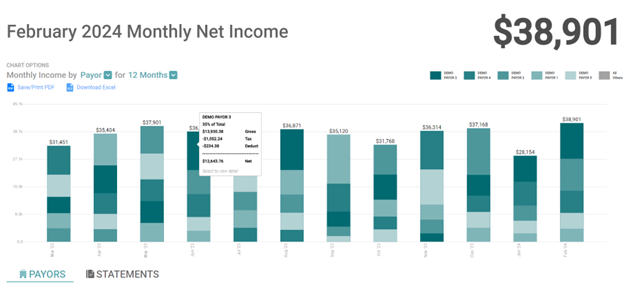

Many of us first compare our 1099 to what we are tracking as our income based on checks received. Through MiQ+, owners can download their income over time (gross/net) for all operators with a single click. No more tracking in Excel or looking at paper check statements.

If you provide your 1099s to your tax professional, you can make their life easier by also providing this Excel file.

Depletion

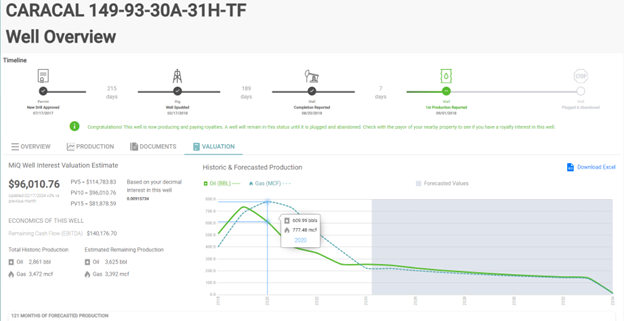

Standard or cost depletion? For many owners taking the standard 15% depletion is easiest but not always most tax efficient. The problem is that cost depletion usually requires assistance from multiple parties to get all the pieces required to fill out the form. Most of the information needed to fill out the tax form is found in your annual filings: gross/net royalty income, severance tax, cost to acquire lease, etc. However, most owners do not have access to reserve calculations, and hiring an engineer to determine the beginning reserves and current production is expensive.

With MiQ+, you can download the estimated ultimate recovery or reserves (EUR) for the wells you receive royalty income on and the production over the last 12 months. These two pieces of information allow the everyday owner to evaluate if cost depletion makes more sense than the standard 15%.

Property Tax

For many owners, taxes are also levied at the county or state level as minerals are considered real property. In Texas, these taxes are released in mineral appraisal tax rolls by each county.

The process that each county takes to determine mineral value is semi-opaque but there are three main companies that complete these valuations; Pritchard & Abbott is the main provider.

The most common method is using a single analogous well for a specific region and then broadly applying its production curve and value to all mineral owners. This is like your home property tax, which is not a specific evaluation of your home but is a generalized value for the area that is applied to all homes. There can be significant errors in this method, resulting in both over- and under-taxing your minerals. Owners can protest the mineral estate value that is provided by the county, but few have the resources to do so. For most, the question is simply whether you should spend the time protesting your tax bill or if the county is tracking your ownership correctly.

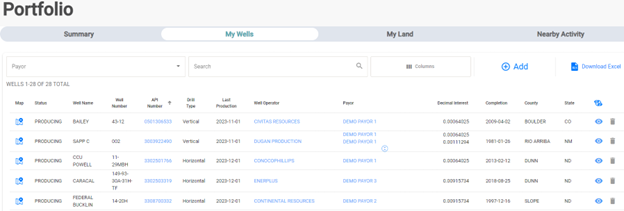

Luckily, MiQ+ offers some of these answers. Since MiQ+ provides a list of your wells in pay and associated decimals, you can check against your tax bill to ensure the decimal ownership is correct.

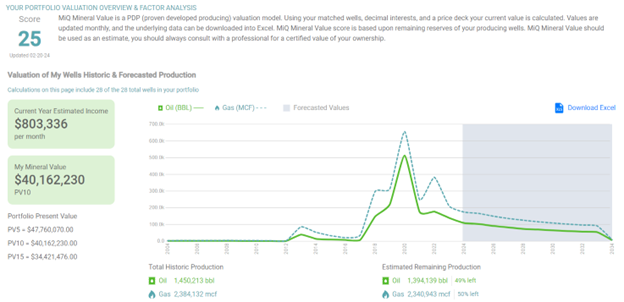

You can also look at your portfolio level valuation or payor level valuation to determine if the taxable value of the assets looks to be high or low.

One of the most important checks during tax season is simply to verify whether the taxes levied look correct. The information in MiQ+ helps you more quickly determine if you should protest your tax bill. Enverus also has analytics-ready county tax rolls in Texas dating back multiple years if you need to access prior year tax assessments.

Tax season is never a fun time. It can be confusing or frustrating. Owning real property like minerals can further complicate the situation as many struggle to understand their tax bills or how to know if they are being levied correctly. With MiQ+, we seek to provide owners with the information they need to make informed choices with their tax professionals.

Sign up for MiQ+ today to simplify the tax-filing process and empower you to take control of your financial future.

Enverus and its affiliates do not provide tax, legal or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before acting on the information provided herein or in the MiQ products.